Introduction

In international trade, different payment devices facilitate transactions between prospective buyers and sellers throughout borders. Comprehension these instruments, for instance expenses of exchange, promissory notes, and documentary collections, is vital for making sure secure and economical payment processes. Each and every instrument serves a novel reason and provides diverse levels of protection and suppleness.

Bills of Trade

Definition and Usage

Definition: A Monthly bill of Trade is a prepared get by 1 bash (the drawer) to a different (the drawee) to pay a specified sum of money to the third party (the payee) on the specified day. It is usually Utilized in Worldwide trade to aid payments.

Utilization: Charges of Trade will often be made use of when the buyer and seller have an established connection. The vendor can attract a bill on the customer, which can be approved and paid at maturity.

Gains: They offer a formal and legally binding instrument for payment, giving security to equally the vendor and the client. The vendor can discount the Invoice with a bank to obtain instant resources, whilst the buyer can approach for that payment about the due day.

Promissory Notes

Definition and Utilization

Definition: A promissory Notice is actually a prepared promise by 1 social gathering (the maker) to pay for a specified sum of cash to another bash (the payee) on the specified date. In contrast to a Monthly bill of Trade, It's really a immediate guarantee to pay in lieu of an purchase into a 3rd party.

Use: Promissory notes are Utilized in different economical transactions, including Worldwide trade, to proof a debt obligation. They in many cases are applied when the customer needs to formalize a payment commitment.

Rewards: Promissory notes offer a straightforward and lawfully enforceable means of documenting a personal debt. They may be transferred or discounted, giving adaptability in financing arrangements.

Documentary Collections

Definition and Usage

Definition: Documentary assortment is usually a method wherever the exporter (vendor) instructs their lender to collect payment in the importer (customer) from the presentation of delivery and industrial documents. The financial institution functions as an middleman, facilitating the Trade of paperwork for payment.

Utilization: Documentary collections are utilised if the exporter wishes to keep up Handle about the shipping and delivery documents until finally payment is gained. They are really ideal for transactions in which the risk of non-payment is fairly lower.

Gains: This process presents a balance among safety and price-success. The exporter retains Command over the documents, making certain that the goods are usually not unveiled right up until payment more info is made, when the importer Rewards from not needing to spend beforehand.

Comparison of Payment Devices

Security and Chance

Expenditures of Exchange: Give you a medium volume of protection, as They can be legally binding and may be discounted. On the other hand, the risk of non-payment continues to be When the drawee defaults.

Promissory Notes: Provide a immediate promise to pay for, cutting down the potential risk of non-payment as compared to expenditures of Trade. On the other hand, they don't provide the exact same level of safety as letters of credit rating.

Documentary Collections: Supply a greater level of stability for that exporter by retaining Management over the shipping and delivery files. On the other hand, they do not give a payment assurance like letters of credit rating.

Expense and Complexity

Charges of Exchange and Promissory Notes: Frequently involve lower fees and therefore are less complicated to use as compared to letters of credit score. They are ideal for transactions the place the get-togethers have founded believe in.

Documentary Collections: Require average charges and complexity. They are more secure than open account transactions but considerably less so than letters of credit history.

Summary

Knowing the several payment instruments in Global trade, including costs of Trade, promissory notes, and documentary collections, is essential for enterprises to manage risks and be certain productive payment processes. Each instrument gives exceptional Positive aspects which is ideal for differing kinds of transactions and threat profiles.

Usually Requested Issues (FAQs)

What is a Monthly bill of exchange in international trade?

A bill of exchange is often a written purchase to pay for a specified sum of cash, accustomed to aid payments involving customers and sellers in international trade.

How does a promissory Take note vary from a Invoice of exchange?

A promissory Take note can be a direct promise to pay for, though a bill of exchange is really an get to a third party to pay. Promissory notes are less complicated and require only two get-togethers.

What exactly are the main advantages of utilizing documentary collections?

Documentary collections offer a equilibrium between security and cost-success, making it possible for the exporter to keep Handle more than shipping and delivery files right until payment is made.

Which payment instrument gives the highest stability?

Letters of credit score present the best protection, as they supply a payment assure from a financial institution. Nevertheless, Also they are the most expensive and complex.

When really should expenses of exchange or promissory notes be utilized?

These instruments are suitable for transactions where the events have established have confidence in and the potential risk of non-payment is comparatively very low.

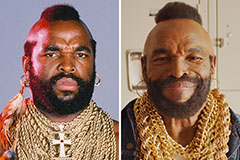

Mr. T Then & Now!

Mr. T Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now!